- Location

- Stoneleigh

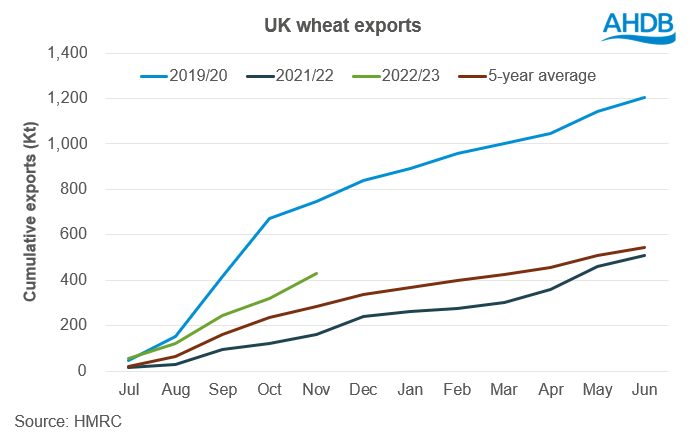

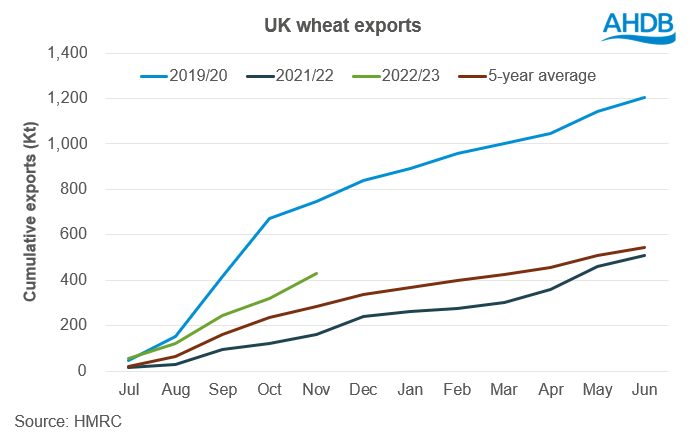

Following a bumper 2022 harvest, on top of relatively subdued demand, the UK is expected to have a substantial exportable surplus of wheat this season. In November’s cereal supply and demand estimates, the surplus available for either export or free stock of wheat was forecast at 2.25Mt in 2022/23, over two and half times 2021/22 levels and the largest surplus since 2015/16. With trade data now available for the season up to November, are UK wheat exports progressing at a pace fast enough to avoid large ending stocks?

In November, the UK exported 112.9Kt of wheat (including durum wheat), 40.7Kt more than was exported in October, and the largest volume for the month of November since 2016/17. This takes UK wheat exports in the season to date (Jul-Nov) up to 432.2Kt. While this is the largest amount exported for this point in the season since 2019/20, it remains relatively low when compared with other seasons that had a c.2Mt exportable surplus. In 2019/20, the UK had an exportable surplus of wheat of 2.09Mt and by November of that season, wheat exports had reached 745.3Kt.

So why the low export volume if we have such a large surplus? There are a number of factors that have contributed to this. Firstly, with such market volatility over the past year, driven by the war in Ukraine, this is likely to have led to some growers to hold on to stock. Looking at the AHDB Corn Returns volume data, the total volume of feed wheat sold for spot and forward delivery from the start of July to date (12 January) is 4% lower than the same period last season. Another major factor that is influencing UK exports, is our competitiveness on the international market. It’s been well reported lately that cheap Black Sea supplies are dominating the export market.

To prevent the UK carrying out a large amount of free stock of wheat this season, the export pace is going to have to ramp up. Whether this will happen or not is yet to be known. For it to be able to happen though, the UK will have to price more competitively on the export market.

Next Thursday (26 January) AHDB will be publishing the January UK cereal supply and demand estimates, which will include the first estimates for exports and end-season stocks of wheat and barley for the season.

Today's Grain Market Daily is now published - UK wheat export pace increases, but is it enough to avoid a large carry-out?

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

In November, the UK exported 112.9Kt of wheat (including durum wheat), 40.7Kt more than was exported in October, and the largest volume for the month of November since 2016/17. This takes UK wheat exports in the season to date (Jul-Nov) up to 432.2Kt. While this is the largest amount exported for this point in the season since 2019/20, it remains relatively low when compared with other seasons that had a c.2Mt exportable surplus. In 2019/20, the UK had an exportable surplus of wheat of 2.09Mt and by November of that season, wheat exports had reached 745.3Kt.

So why the low export volume if we have such a large surplus? There are a number of factors that have contributed to this. Firstly, with such market volatility over the past year, driven by the war in Ukraine, this is likely to have led to some growers to hold on to stock. Looking at the AHDB Corn Returns volume data, the total volume of feed wheat sold for spot and forward delivery from the start of July to date (12 January) is 4% lower than the same period last season. Another major factor that is influencing UK exports, is our competitiveness on the international market. It’s been well reported lately that cheap Black Sea supplies are dominating the export market.

To prevent the UK carrying out a large amount of free stock of wheat this season, the export pace is going to have to ramp up. Whether this will happen or not is yet to be known. For it to be able to happen though, the UK will have to price more competitively on the export market.

Next Thursday (26 January) AHDB will be publishing the January UK cereal supply and demand estimates, which will include the first estimates for exports and end-season stocks of wheat and barley for the season.

Today's Grain Market Daily is now published - UK wheat export pace increases, but is it enough to avoid a large carry-out?

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.