- Location

- Stoneleigh

The U.S. Department of Energy (DOE) yesterday announced $118 million in funding to expand U.S. biofuels production in 17 different projects, which will be designed to accelerate the production of biofuels. An announcement like this and the direction of the Biden administration on cutting greenhouse gas emissions suggest that demand for soyabean oil is likely to remain strong.

Over the last year soyabean oil has had a momentous growth in biofuel feed stock in the U.S. and has led to the premium that we are currently seeing in the vegetable oil complex.

However, rapeseed prices still have the ability to drop despite the strong demand for soyabean crush in the U.S.

Chicago soyabean oil prices dropped with crude oil in late November, though stronger meal prices have meant that margins have remained strong despite dropping back slightly.

However, margins are so strong currently that soyabean prices still have the ability to drop and for margins to remain positive.

Global supply of rapeseed for this marketing year (2022/23) has significantly improved, and rapeseed’s premium has diminished.

Currently keeping rapeseed prices supported is the high price of soyabeans on the back of strong soyabean oil demand in the US, and the generally supported oilseed complex from the Russia Ukraine war.

However, what is critical to note is that we have a large Brazilian soyabean crop coming to market in the coming months with harvest just starting now. Further to that, as mentioned in the introduction, the perceived US demand for soyabean oil is going to remain strong going forward, which to some extent will keep soyabean oil prices elevated. If realised, this will keep crush margins strong meaning that the price of soyabeans will have the ability to drop when this large Brazilian soyabean crop comes to market, which could have the potential to weigh on domestic UK rapeseed prices.

Today's Grain Market Daily is now published - Strong demand for soyabeans, what does that mean for rapeseed?

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

Over the last year soyabean oil has had a momentous growth in biofuel feed stock in the U.S. and has led to the premium that we are currently seeing in the vegetable oil complex.

However, rapeseed prices still have the ability to drop despite the strong demand for soyabean crush in the U.S.

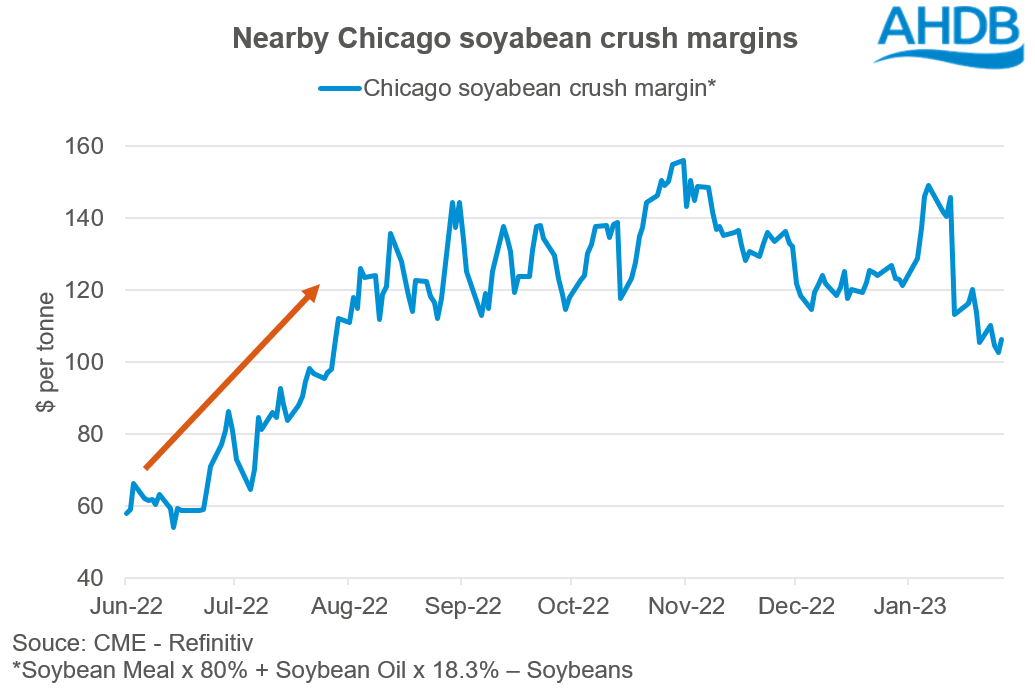

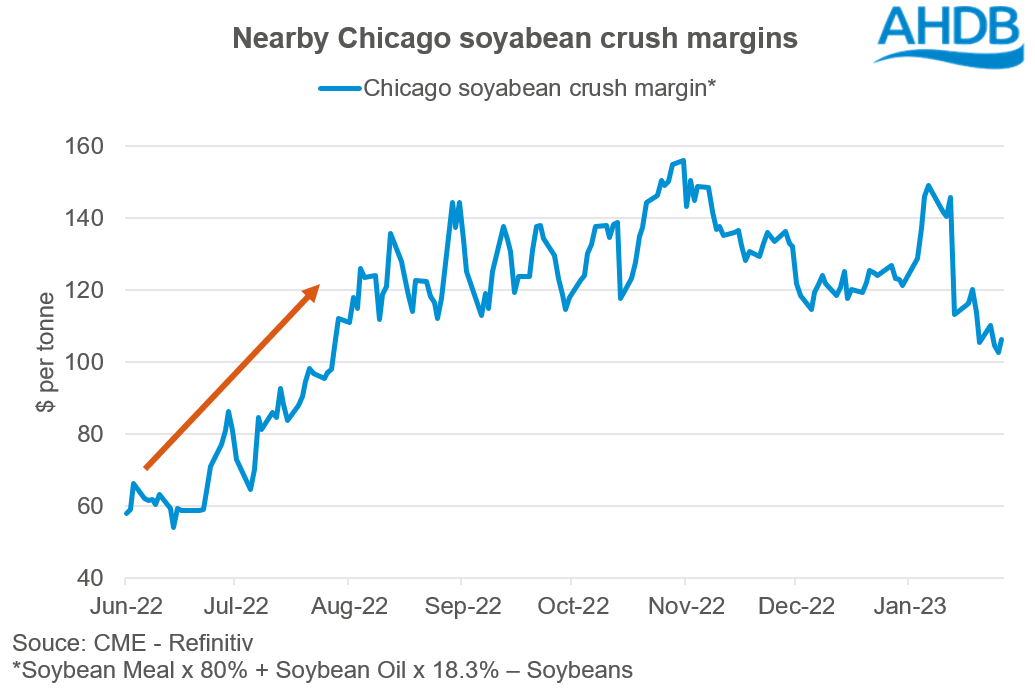

Strong crush margins

Currently in the U.S. soyabean crush margins are strong. Since June 2022 crush margins have grown as the price of soyabeans has been on an upward trend, which has been climbing off the back of the demand from the U.S. biofuel industry and to some extent the Argentinian drought has elevated prices too.

Chicago soyabean oil prices dropped with crude oil in late November, though stronger meal prices have meant that margins have remained strong despite dropping back slightly.

However, margins are so strong currently that soyabean prices still have the ability to drop and for margins to remain positive.

Soyabeans keeping rapeseed elevated?

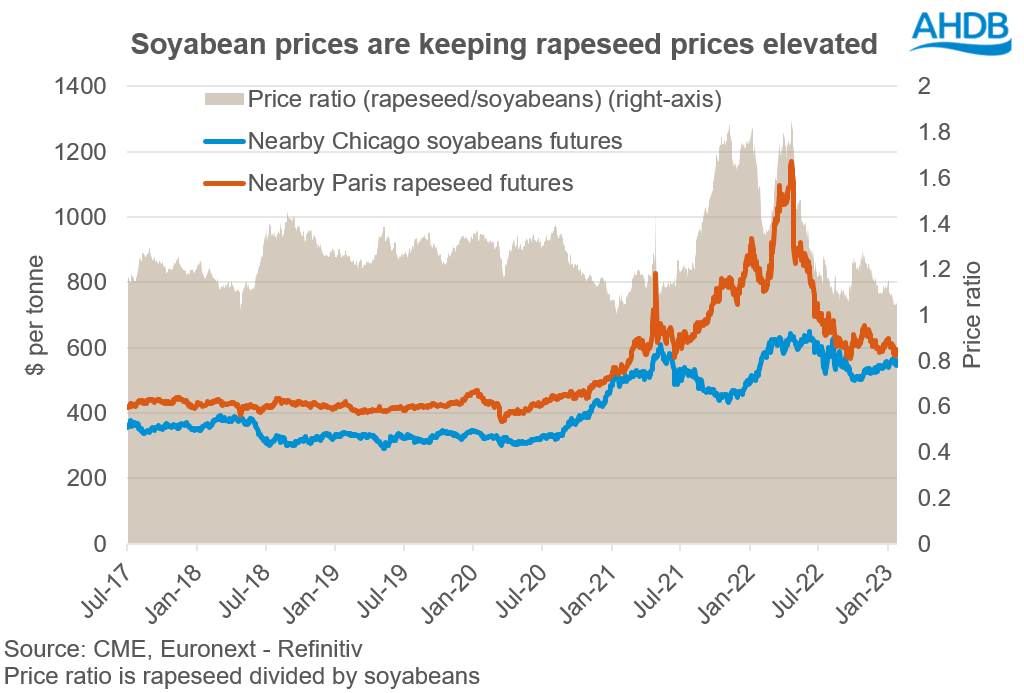

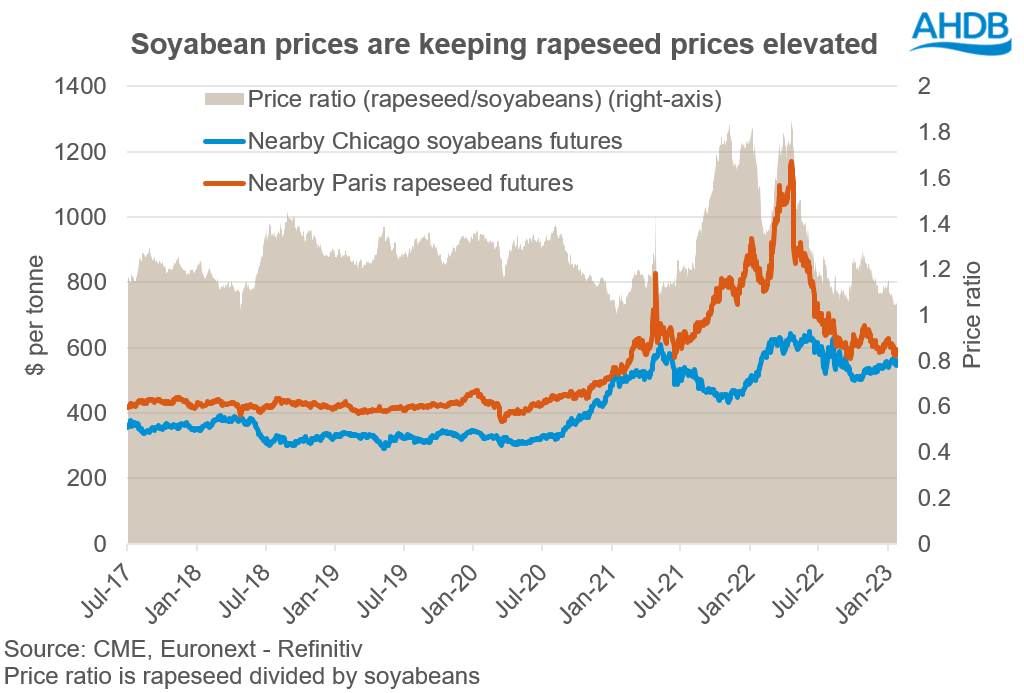

Historically, Paris rapeseed futures have been at a premium to Chicago soyabean futures (in US dollar terms). However, the price ratio between the two commodities has been touching near parity. To some extent the price of soyabeans has been keeping rapeseed prices elevated in recent weeks.

Global supply of rapeseed for this marketing year (2022/23) has significantly improved, and rapeseed’s premium has diminished.

Currently keeping rapeseed prices supported is the high price of soyabeans on the back of strong soyabean oil demand in the US, and the generally supported oilseed complex from the Russia Ukraine war.

However, what is critical to note is that we have a large Brazilian soyabean crop coming to market in the coming months with harvest just starting now. Further to that, as mentioned in the introduction, the perceived US demand for soyabean oil is going to remain strong going forward, which to some extent will keep soyabean oil prices elevated. If realised, this will keep crush margins strong meaning that the price of soyabeans will have the ability to drop when this large Brazilian soyabean crop comes to market, which could have the potential to weigh on domestic UK rapeseed prices.

Today's Grain Market Daily is now published - Strong demand for soyabeans, what does that mean for rapeseed?

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.